reit dividend tax malaysia

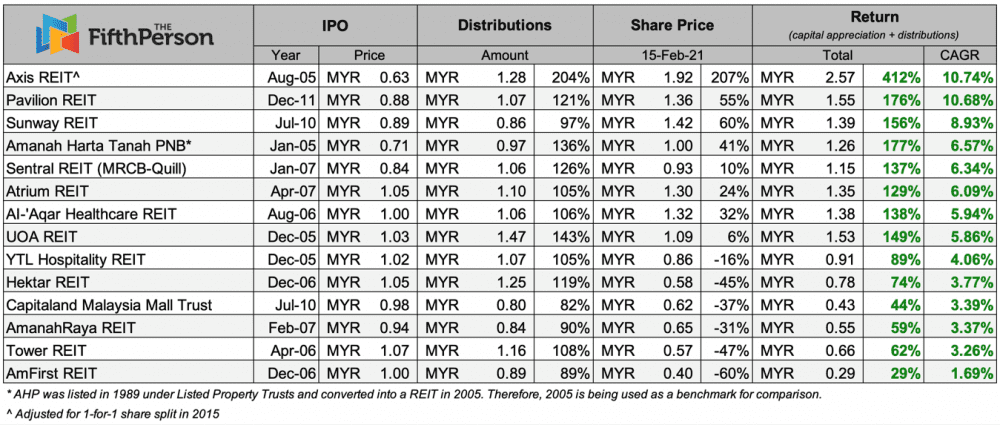

686 Since 2007 every RM1000 investment in Sentral REIT previously known as MRCB-Quill REIT wouldve turned into RM1100. Including dividends every RM1000 would cumulatively become RM2370.

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Otherwise the total income of the REITs will be taxed at the relevant rate of income.

. But do note that distributions from Malaysian REITs to individual investors are subject to a 10 dividend withholding tax 4. Here are five reasons why you should invest in REITs in Malaysia. Withholding tax of 10 or 25.

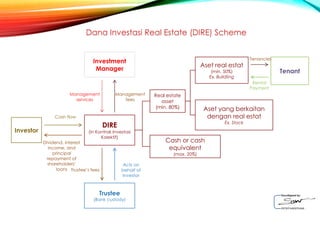

6 in 2026 plus a separate 3 plus a separate 3 plus a. In a nutshell thats how REITs work. Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders.

Since the income distributed by REITs are tax exempt no tax credit under subsection 110 9A of the Income Tax Act ITA 1967. Of this 120 of the dividend comes from earnings. REITs in Malaysia and around the world benefit from favorable tax treatment and typically give larger dividend yields than other corporations.

If 90 or more of its total income is distributed to unit holders a real estate investment trust in Malaysia will be exempt from income tax. Retail REITs shopping malls. However unit holders are liable to tax on the distribution of income.

But to get started with MREITs you just need. Countries such as UK Singapore Hong Kong and Malaysia have no dividend tax and have dividend yields above the global average. It has strong cornerstone investor which is Frasers Centrepoint Trust listed in Singapore.

3 Years Continuous Growing. As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the a 25 income tax. Taxation and tax exemption of REITs in Malaysia.

Below is the a chart of average dividend yield by country in 2019. The remaining 060 comes from depreciation and. The first real estate investment trust REIT established in.

No real authority or involvement over the management aspects. Taxation of dividend income distributed by REIT in the hand of investors. Types of REITs A list of all 18 Malaysian REITs which are listed on Bursa Malaysia.

The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders. This allows the REIT to distribute its income on a gross basis. If a Real Estate Investment Trusts fund distributed at least 90 percent of their total yearly income to unit holders the REIT itself is exempted from tax for that year of assessment.

You still have to pay withholding tax. Hospitality REITs hotels and serviced residences. Here we have highlighted the Top 10 REITs in Malaysia by market cap.

The first real estate investment trust was established in the United States in 1960 providing investors with the chance to participate in massive real estate holdings. Industrial REITs warehouses logistics facilities and data centres. Amanah Harta Tanah Annualised return.

With close to 4 dividend yield and a strong currency Singapore is one of the. Most property investments require a significant amount of money to start. In Malaysia there are mainly 5 types of REITs.

Today there are a total of 17 REITs in Malaysia each of them with different properties including malls offices hotels factories etc. Hektar is the first retail focused reit in Malaysia. Sentral REIT Annualised return.

Office REITs office buildings. The government currently imposes a 10 withholding tax on REIT dividends to local and non-resident individual investors. Even with a 90 loan a RM500000 property would require at least RM50000 down payment plus extra for legal fees and stamp duties.

19 rows Monthly Dividends Portfolios. Market Trading Participation Statistics. ARREIT has gearing of 4365 and involved in office building educational industrial hotels and.

This exemption only applies to those listed on Bursa Malaysia. In a case where dividend income forms part of the total income distributed to unit holders the tax credit from tax at source is given to the REITPTF and the tax computation at REITPTF and. With this tax system most Malaysian REITs if not all always distributes at least 90 of its.

A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at least 90 of its total income to the unit holders during the year. REITs in Malaysia are exempted from the 25 income tax if they distribute at least 90 of their current year taxable income. Dividends received by REITs are taxable as ordinary income up to a maximum rate of 37 returning to 390.

Dividend yields tend to be higher in countries without dividend tax. Gearing is the highest as well at 442. REITPTF level-subject to tax 2000-not subject to tax REITPTF 10000 -not subject to tax REITPTF 14000 Distribution from REITPTF Distribution from REITPTF Year 2 RM Year 1 RM 3.

One huge tax benefit of a REIT is that most income earned by it is exempted from income tax.

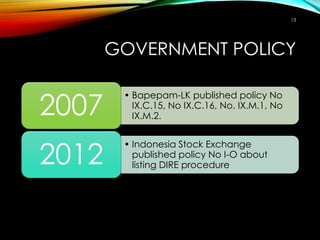

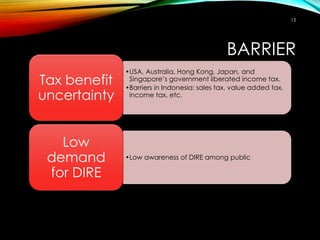

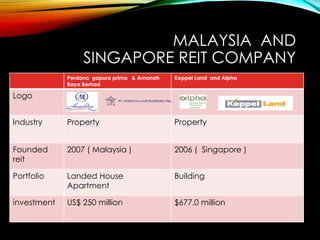

Reit Company Indo Usa Malaysia Singapore

Dividend Taxes Malaysia Archives Dividend Magic

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Pdf Malaysian Real Estate Investment Trusts M Reits A Performance And Comparative Analysis Semantic Scholar

Reit Company Indo Usa Malaysia Singapore

Reit Company Indo Usa Malaysia Singapore

Reit Company Indo Usa Malaysia Singapore

Nav And Dpu Of Ireits In Malaysia Download Scientific Diagram

Reit Regulatory Structure And Characteristics For Nigeria And Malaysia Download Table

Reit Company Indo Usa Malaysia Singapore

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

Axis Reit Archives Dividend Magic

Reit Company Indo Usa Malaysia Singapore

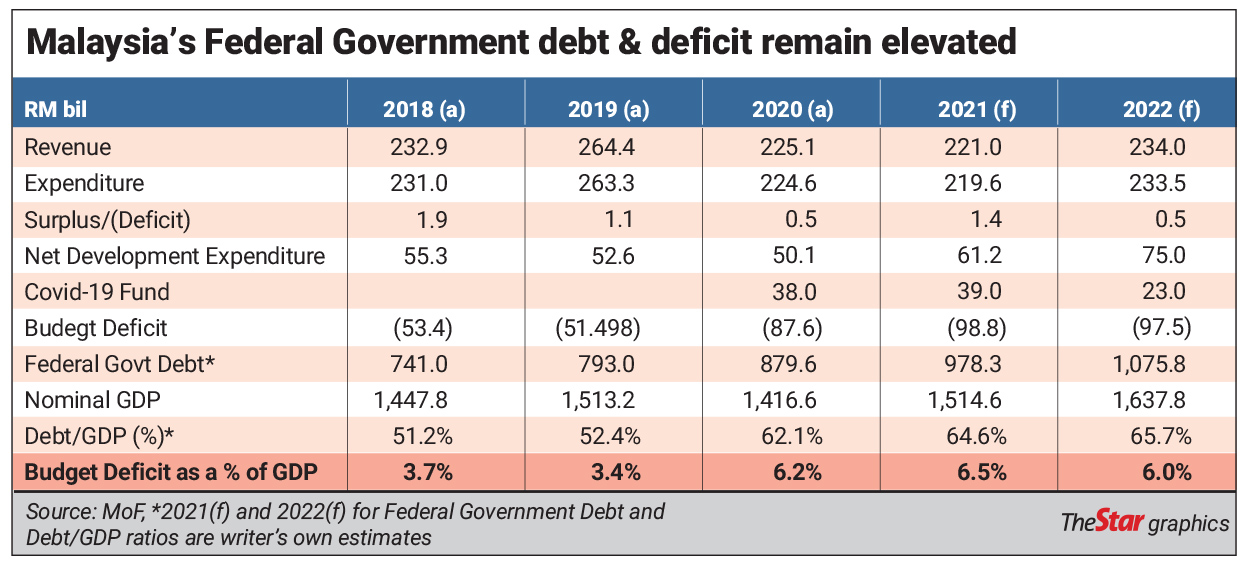

Higher Taxes Are Inevitable The Star

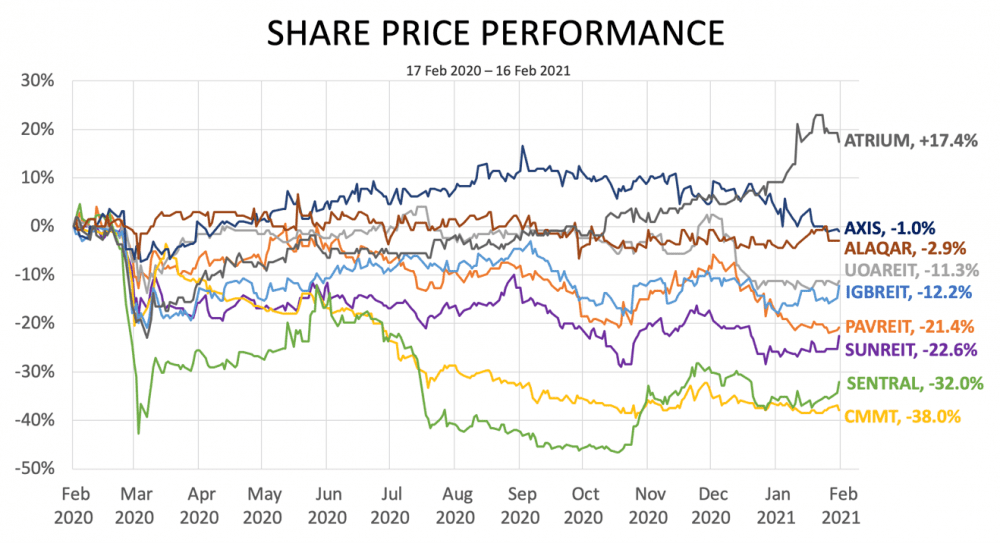

Post Pandemic Comeback Of Malaysian Reits The Star

Pdf Performance Determinants Of Malaysian Real Estate Investment Trusts

The Complete Guide To Reits In Malaysia Dividend Magic Malaysia Tourist Places Tourist Places Places To Visit